Financially, 2022 wasn’t so bad of a year after all. We are bombarded with bad news, because bad news attracts viewers and follower to news outlets, but a -10 return for a year is not a catastrophe. In Markets where we see rates of return in excess of 10%, having a negative year should be viewed as normal. Volatility is the price we pay in the stock market in order to have superior returns.

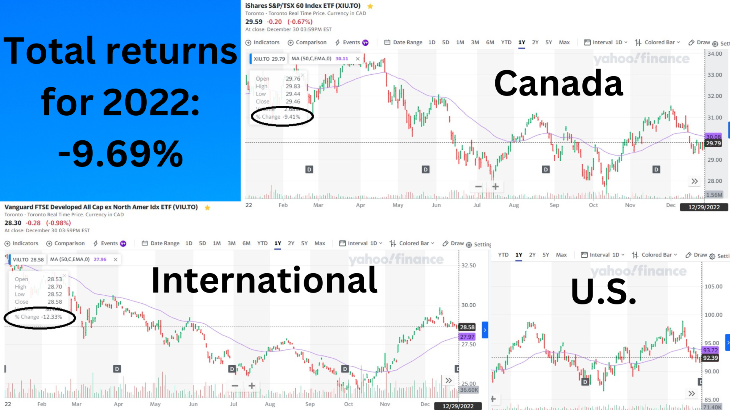

Generally, my investments are divided into three parts:

- 1/3 U.S.

- 1/3 Canada

- 1/3 International.

When we add dividend to the total rate of return, this were my total returns for the year:

VFV (US index) : -12.68

XIU (Canadian index): -6.36

VIU (International Index): -10.02

Average return: -9.69

This is the same portfolio that I recommend to all my friends. Whether they are 19 year old or 95 year old. Whether they are planning to use the money next year or twenty year from today.

Yes, there are so many variable, but so far, in all my years as an investor, it has proven to be the right decision.

If we look back at previous years, this is how this year compares:

My total return for 2022 was -9.69

My total return for 2021 was 19%

My total return for 2020 was 7.88

My total return for 2019 was 20.30

My total return for 2018 was -9.54

Average rate of return for the past 5 years was 5.59, which is not great, but considering that the only work necessary to earn that return was to make a few clicks on my computer, that’s not bad at all. I don’t event have to think any more. I just invest in the same thing year after year.

If we compare stock market returns with the returns of real estate which is full hassles and responsibilities, stocks performed quite well.

If we compare stock market returns with bonds or other investments, the stock market return is also favorable. For that reason, my cookie cutter advice, to everyone, no matter age or life circumstances, it to go all in into index investing in the stock market.

Previous stock market posts