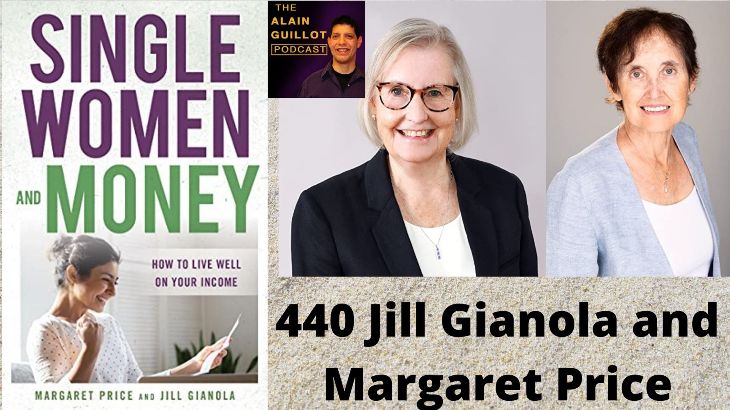

About Jill Gianola

Jill Gianola is a CERTIFIED FINANCIAL PLANNER™ Professional and is an Investment Adviser Representative with the State of Ohio. She holds a master’s degree in economics from the University of Wisconsin and an MBA from the University of Illinois

Jill has been quoted in several publications, including the New York Times, Wall Street Journal, Fortune, Barron’s, Money Magazine, Kiplinger’s, Mutual Funds Magazine, Working Woman, and the Columbus Dispatch. Jill is the author of The Young Couple’s Guide to Growing Rich Together.

Jill is a member of the Alliance of Comprehensive Planners and the National Association of Personal Financial Advisors and has served on the board of directors of both organizations. She taught economics at Wittenberg University as an Adjunct Instructor.

About Margaret Price

Margaret Price is an author, editor, and journalist. She has been an editor at Bloomberg Wealth Manager publication, international editor at Crain Communications’ Pensions & Investments magazine, and senior editor at Treasury & Risk Management publication.

She also has written for such prominent publications as Investor’s Business Daily, New York Daily News, Newsday newspaper and the Christian Science Monitor.

Price is a member and past president of the New York Financial Writers’ Association. She also is the author of the book Emerging Stock Markets: A Complete Investment Guide to New Markets around the World.

Active in her community, she is co‐chair of the Women and Families Committee of Community Board 8– Manhattan. Price is a 2021 recipient of a New York State Women of Distinction award, presented by State Assembly Member Rebecca Seawright.

You can find Margaret on Twitter.

Single Women and Money: How to Live Well on Your Income

Finally, there’s a money guide to help single women survive and thrive.

Single Women and Money is a highly readable guide that helps single women live a financially secure and successful life. It’s a book for the millions of unmarried women in America who must make ends meet on a single salary—which is typically less than what men earn.

Using stories of actual women, as well as data and experts’ insights, the book chronicles the financial issues of single women. It provides the tools needed to tackle their daily and longer-term needs and probes the issues specific to divorcees, widows, women who never married, and single mothers.

Single women reveal their moving stories detailing how many have overcome obstacles. From there, the book provides a wide range of specific guidance on money issues targeted to singles. These include saving, spending wisely, managing with children, shedding debt, investing in line with your values, planning for retirement and long-term care, navigating Social Security, paying taxes, landing a job after age 55, protecting financial assets and leaving a legacy.

Offering resources women can turn to in hard times, the authors also suggest ways society can, and should, assist single women. Check out the book’s website here.