Investing your money in Environmental, Social, and Governance funds is a bad idea and it’s costing you a lot of money.

Investors are finding out that ESG funds (Environmental, Social, and Governance) are a big failure, and they are bailing out of these underperforming funds as fast as they can.

ESG is a framework used to evaluate the sustainability and ethical impact of a company’s operations. It’s a idealistic idea, but it has nothing to show for it except losses for its investors.

The idea is that you can do good and make money at the same time. Unfortunately, that’s not true. ESG funds tend to underperform the market, and they don’t do that much good anyway.

Why ESG funds underperform the market

The reasons are logical and make sense. If managers optimize their investments for ESG and not for profitability, it’s only logical that they will underperform on profitability. For example, Tesla (TSLA) has a low ESG score of 25 while being one of the most profitable companies of the century. A manager who chooses not to invest in Tesla is missing out on a 1,200% (240%/y) return in the past five years. Meanwhile, Colgate-Palmolive (CL) has a high ESG score of 69 and a dismal performance of 25% in five years. A fund focused on ESG would have missed the great returns of Tesla and stayed with the meager returns of Colgate-Palmolive.

ESG funds have a additional level of bureaucracy

ESG funds are more expensive to run, have an extra level of bureaucracy, and have to spend lots of money on marketing to promote themselves, while a person simply investing in the S&P 500 will do much better. The S&P index is one of the least expensive index in North America, has no bureaucracy since it is now run by Artificial Intelligence, and spends no money on marketing since their marketing is their dirt-cheap fees.

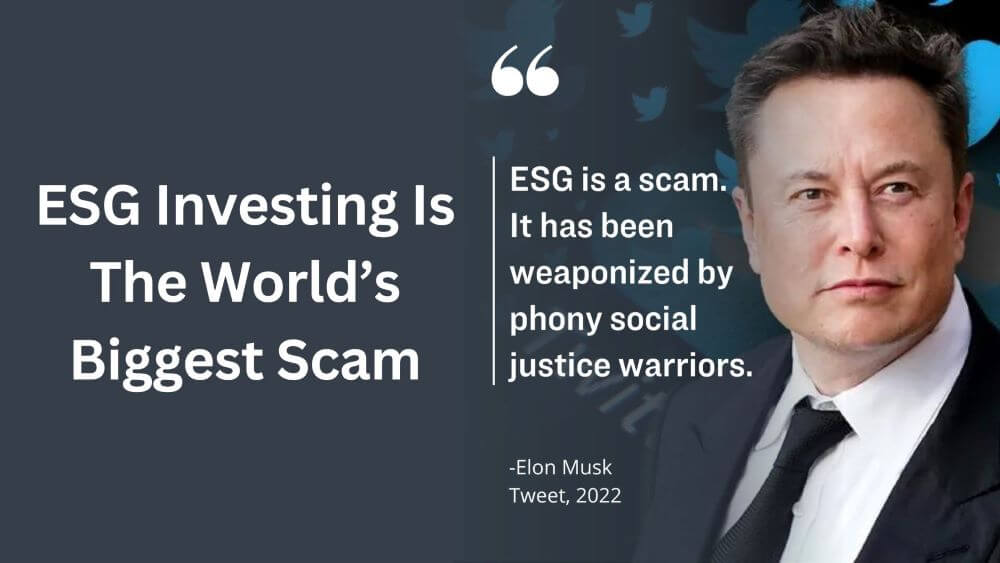

ESG funds seem to have a political agenda

Oftentimes, companies that hire black transgender women get a higher ranking than companies that hire white, straight, Christian people, regardless of which hiring practice is more profitable for the shareholders.

An example of this was Claudine Gay, former president of Harvard University. She was given the post of President of Harvard University mostly because she is black, a woman, and a lesbian, thus ticking three boxes of diversity and inclusion with just one person. However, she quickly demonstrated that she was unqualified for the job; in addition, it was discovered that she plagiarized works by white male professors.

Another big failure, in the name of diversity and inclusion, was when Bud Light hired transgender Dylan Mulvaney to do some of their advertising. The result was a huge backlash by its core clientele. Estimated lost revenue was in the range of $100 to $200 million. The company’s market capitalization dropped by approximately $5 billion.

ESG funds have a hard to understand logic

There are issues that I don’t understand. For example, Tesla, whose main purpose is to produce electric vehicles and reduce pollution, has a very low ESG score, while Philip Morris, whose main product is cancer-inducing cigarettes that can kill their clients, has a high ESG score. How could cigarettes, which kill over 8 million people a year, be deemed a more ethical investment than electric cars?

Conclusion

My suggestion for any one who wants to make money and do good, is to buy the regular S&P 500, with a dirt cheap management fee of less than 0.05% and donate money to the charity organization of your choosing, or buy products and services from companies that conform to your values.

Previous opinion posts