Every day, there are many companies experiencing significant price drops. There is a section on Yahoo Finance called “Day Losers” where the biggest losers of the day are highlighted.

Are those good buying opportunities?

Maybe.

All of our favorite Blue Chip stocks have been part of this list. Some of those stocks have recovered, while others continued their downward slide. The truth is that we never know for sure which stock will recover and which one will just disappear. Remember Nortel, Nokia, Kodak, BlackBerry, Blockbuster, RadioShack, Toys R Us? These were stock market leaders that never recovered.

On the other hand, for those investors who have bought the U.S. or Canadian index, they have always seen their money coming back after any major drop.

Instead of discussing the pros and cons of buying any individual stock, I think we should look at the big picture and talk about the difference between buying a basket of individual stocks when they are down versus buying the index.

The main difference between buying any individual stock and buying the index when they both go down is that, up to now, the index has always bounced back, while some of the blue-chip stocks that we have learned to love/trust might never recuperate. Kodak, Blockbuster and Nokia never recuperated. They slowly declined into the graveyard of market history.

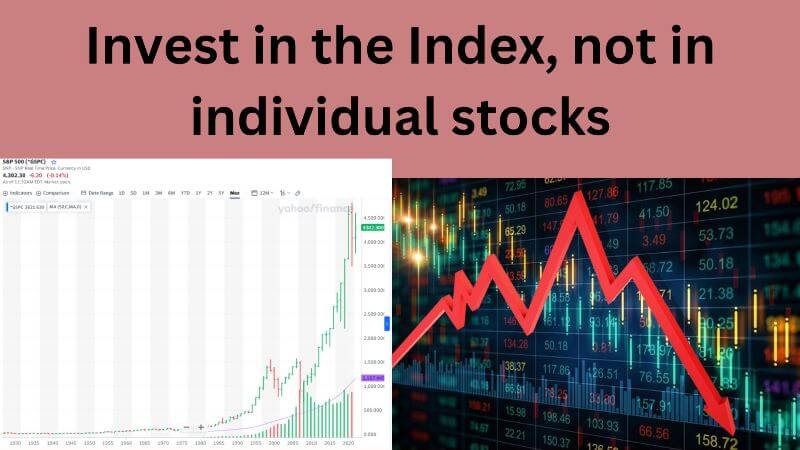

On the other hand, the S&P 500, which came into existence in 1957, has seen many deep declines and it has always recovered:

- Black Monday: Oct. 19, 1987

- Dotcom bubble crash: 2000-2002

- Global financial crisis: 2008-2009

- COVID-19 pandemic: 2020

Why? Because, unlike individual stocks, the S&P 500 is always changing.

Looking at this graph, you might think that you could have invested $20 in the most popular stocks of 1927 and just waited to get rich. But it doesn’t work out that way. The companies that represented U.S. stocks in 1927 are very different from the companies that represent U.S. stocks in 2023. Most of the original companies composing the S&P 500 no longer exist, but the S&P is still going strong.

Regardless of how quickly companies are moving in and out of the index, you can see that owning an index is fundamentally different from owning a basket of individual stocks. While your basket of individual stocks might remain the same over time, the index will not.

There are many benefits provided to index investors.

We get the highest returns and pay the lowest fees. Hundreds of analysts go on a hunt for the best stocks; they spend their time, money, and energy crunching numbers, buying the stocks that are going up and selling the stocks that are going down, and we get to reap the rewards.

According to the SPIVA Report, the S&P 500 index has outperformed 92% of money manager professional over the past 15 years, and the cost to us is usually 0.05%/year. There is no better deal in town.

Previous stock market posts