Category: Stock Market

-

These three ETFs are responsible for most of my wealth

in Stock MarketI was a day trader for almost 10 years. Oh, I was so smart. I was smarter than the market and all its participants. But I was not, I was delusional. I wasted my time trying to guest the direction of the markets. I had good months in which I felt I was going to…

-

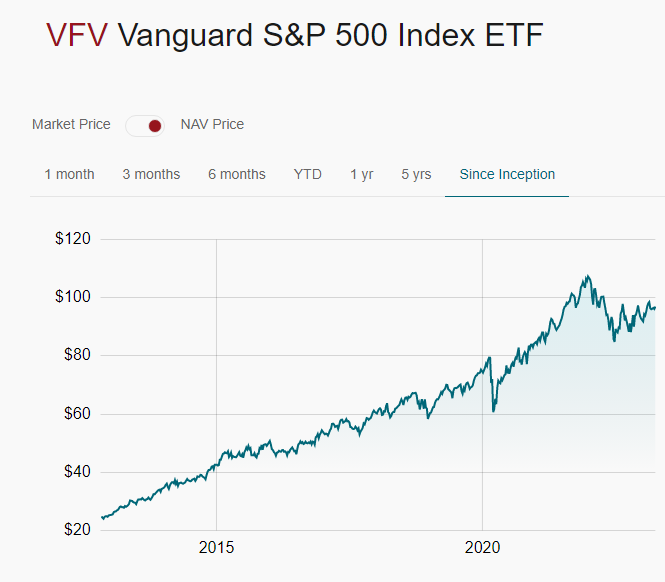

Vanguard S&P 500 is one third of my portfolio

in Stock MarketMy investment strategy is to buy more every time I have more money. I don’t time the market. I know that investments (on the long run) will eventually go up. No one know when the market will tank or when it will rally. So why waste my brain energy trying to stay informed and anticipate,…

-

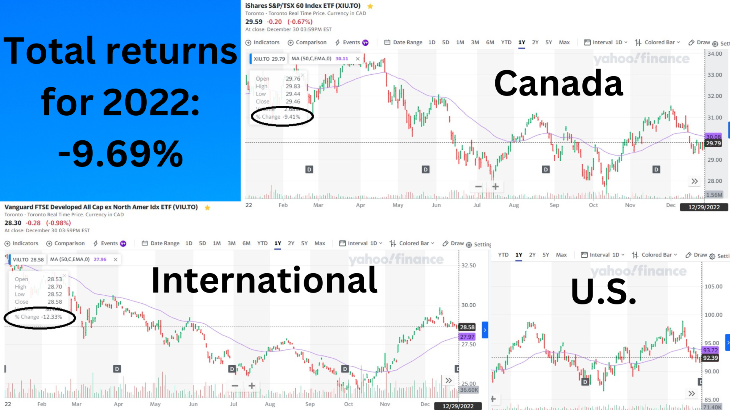

Stock market returns for 2022: -9.69%

in Stock MarketFinancially, 2022 wasn’t so bad of a year after all. We are bombarded with bad news, because bad news attracts viewers and follower to news outlets, but a -10 return for a year is not a catastrophe. In Markets where we see rates of return in excess of 10%, having a negative year should be…

-

5 Reasons Why Focusing on Dividend Stocks May Not Be the Best Investment Strategy

in Stock MarketI see many blogs talking about dividend investment, but dividend investment doesn’t make sense to me, here are five reasons why. Focusing on dividend stocks is a popular investment strategy among income-seeking investors, as it allows them to receive regular payments in the form of dividends while potentially also benefiting from capital appreciation in the…

-

“Buy And Hold,” Money managers don’t follow their own advice

in Stock MarketIf you use a financial advisor you are losing money I quick look at the SPIVA report and you will discover that about 90% of actively managed mutual funds and index funds DON’T beat the index, yet those are the funds all commission based financial advisor will recommend, because those are the funds that pay…

-

The benefits of diversification in a down market

in Stock MarketMany years ago I gave up trying to pick winners and losers in the stock market. I decided to be the market, instead of trying to beat the market. When we look a bit closer at a regular stock market index like the S&P 500, we discover that there are many losers, a whole bunch…